Original article here.

Relationships between, on the one hand, law, behavioral insights, and other fields of study and, on the other, public administrations are giving rise to an exciting field of cutting-edge academic work and practical applications all around the world. There is still relatively little research and few publications about behavioral insights from a legal point of view and in relation to Law. This is surprising, taking into account the premise that Law is a behavioral system due to the fact that it seeks to shape human behavior to behave in certain ways and not to behave in others.

It is even more difficult to find works including a transdisciplinary perspective with contributions from both academia and the professional world. In this regard, in the field of behavioral law, for instance, there is a manifest need to incorporate a significant role for transdisciplinarity in order to solve complex problems, which therefore requires a degree of humility from legal scholars to facilitate a fruitful dialog with other subject areas. However, in the context of this transdisciplinarity, behavioral law asserts its crucial role within the broader area of social science, which, in turn, must refrain from adopting an approach to the analysis of reality that disregards the law and the existing legal framework, as often still occurs. With growing force, various advocates, including authoritative voices such as the League of European Research Universities (LERU) are increasingly emphasizing the importance of interdisciplinary research (and teaching) to unleash the potential of university sector and social innovation, highlighting the obstacles faced to achieve this interdisciplinarity in practice and making proposals to overcome them. In the belief that such a transdisciplinary approach could play a key role, a thematic transdisciplinary research network («Nudging applied to the Improvement of Regulation») was created in 2019; this was the winner of the Spanish 2018 call for grants corresponding to the dynamization actions «Research Networks», of the State Program for Knowledge Generation and Scientific and Technological Strengthening of the R&D&I System. Since 2019, 19 people from six different universities and two public institutions with varied professional profiles, including Law, Economics, Psychology, Political Science, Linguistics, and Sociology have been working with international partners on the topic of law, behavioral insights, and improvement of government. Over the course of these years, with various difficulties and with varying degrees of success, we have tried to create a common language, one of the greatest challenges faced by academics who endeavor to work by means of an approach which has tried to combine insights from different fields.

We have published several analyses related to the aforementioned subjects, in addition to regularly maintaining a website and a blog still active. One of the results of this network is the recently published collective book Nudging’s Contributions to Good Governance and Good Administration – Legal Nudges in Public and Private Sectors, which has appeared in the European Public Law Series / Bibliothèque de Droit Public Européen, vol. CXXVI, published by the European Public Law Organization (EPLO). This book deals with the relationship between Law (including various branches of law, such as constitutional, administrative, and tax law), other sciences (Economics, Linguistics, and Political Science, especially) and behavioral insights in order to make effective the relevant right to good administration, included in article 41 of the European Union Charter of Fundamental Rights as well as in other international instruments and in international and national case law. This is another reason for the relevance of the book beyond trandisciplinarity: the link between behavioral insights, nudges, and the right to good administration. European Union (EU) case law has established that it must be emphasized at the outset that the diligent and impartial treatment of a complaint is associated with the right to sound administration, which is “one of the general principles that are observed in a State governed by the rule of law and are common to the constitutional traditions of the Member States” (Case T-54/99, Max.mobil Telekommunikation Service GmbH v. Commission of the European Communities, [2002] ECR II-00313, para. 57). This EU case law has insisted that there is a legal obligation to develop functions with due diligence or due care in order to fulfill the duties connected with the right to good administration, avoiding taking into account irrelevant elements, including biases. The Court of Justice of the European Union (ECJ) has underlined that it is apparent from established case law that that principle imposes a duty on the competent institution to examine carefully and impartially all the relevant aspects of the individual case and disregard irrelevant elements, such as cognitive biases. Although US Law does not use the words “good administration”, its spirit is found in the judicial approach known as the “hard look” doctrine. It is also known as “reasoned decision-making”, a widely employed standard that shows how in modern American public law the emphasis has shifted from reviewing arbitrariness towards scrutinizing the quality of the agency’s reasoning. In that context, the book we are considering analyzes how different nudges can improve the functioning of public administrations in an effective and inexpensive way, preventing corruption and maladministration. It also analyzes how nudging could lead to a better regulation of the private sector in several fields, improving compliance through a less intrusive public intervention that respects the relevant legal principle of proportionality. This is another really relevant question: how to reduce authoritarianism in Public Law by considering the legal principle of proportionality and the use of nudges.

As is known, according to the principle of proportionality, widely used in European law, any public decision must respect three filters; in addition to the incentive seeking a general interest (suitability) and its benefits outweighing its costs (proportionality strictu sensu), the necessity test is crucial. To pass this third filter, when seeking the general interest, it is necessary for the decision to choose the alternative that affects citizen rights as little as possible, in other words the least burdensome option. This subprinciple implies that decision-makers must consider various alternatives, since they must weigh the relevant elements for making the decision (as required by their obligation of good administration) in order to choose the least burdensome option for the citizen. Legal systems explicitly state this obligation is derived from the right to good administration and the principle of proportionality. Thus, if nudges are less invasive of citizens’ original freedom than regulatory limitations or prohibitions and are at least as effective, then the principle of proportionality will impose the use of nudges. It is precisely here that there is a bridging concept, that of effectiveness, which helps Law to establish a connection with other disciplines (Sociology, Political Science, Economics, etc.), since how could an administrative decision-maker know the effectiveness of one or another measure to be adopted if not on the basis of the available evidence?

To sum up, the book underlines the idea that authorities are obliged to nudge in those circumstances. It is necessary to take into account that mainstream Law in general, including Administrative Law and Tax Law in particular as branches of law with a close connection with good administration, has not been very sensitive to these developments. Take the case of Administrative Law, which is considered in Professor Velasco´s chapter in the book.

Since its inception in the early 19th century, administrative law has been highly positive (i.e., written) and mainly statutory, quite detailed and meant to be strictly applied through rational methods (logical-subsumptive) to specific disputes or cases. Accordingly, teaching administrative law in higher education traditionally entails explaining statutes and precedents, as well as training in rational methods (hermeneutics, adjudication, dealing with conceptual schemes) for the application of general rules to specific problems or issues. This pedagogical approach does not reflect contemporary advances in cognitive psychology, which distinguishes between rational and automatic thinking. Traditional teaching of administrative law neglects the fact that most of the decisions, opinions, and actions of jurists and public employees take place in contexts of “low cognitive elaboration” and are therefore affected by many intuitive and automatic elements. These automatic responses respond to previous impressions, stereotypes, and attitudes that, to a large extent, have been shaped and conveyed in law schools.

The book also considers some relevant factors in the formation of the impressions, stereotypes, and attitudes of the future enforcers of administrative law: subjective conditions of the lecturers; concepts used in teaching; classificatory schemes or conceptual systems used to explain positive law; sector-specific statutes chosen to explain the general contents of administrative law; the selection of the examples and the use of prototypes; the explanatory language and the use of “prime words”; and the relevance of legal discussions for the shaping and anchoring of legal impressions, stereotypes, and attitudes. Regarding tax law, professor Rozas and Grande explain how the approach of behavioral insights seeks to use understanding of how and why people make decisions in a world of uncertainty so that tax authorities can design interventions that are more effective and efficient. The behavioral sciences offer both methods and a repository of knowledge that are transversal and can provide other disciplines with a box of behavioral tools for use in the pursuit of good governance in tax law and good tax administration. In that sense, European Union tax law draws a fine distinction between “measures” to guarantee compliance with the rules and “penalties” that have the same aim. Both kinds of provisions are referred to with the same qualifying adjectives: “effective, proportionate and dissuasive”. The “measures”, which are alternatives that complement the “penalties”, cover a whole panoply of policies and normative provisions by which the behavioral sciences, drawing on what we know of how human beings make decisions, can help to achieve a better result in terms of voluntary tax compliance. These measures, policies, and tax rules can be categorized on the basis of their immediate goal. Specifically, they are aimed at preventing non-compliance, incentivizing certain behaviors that grease the normal operation of the tax system, and disincentivizing or deterring harmful conduct, that is, frightening the non-compliant taxpayer.

“Carrot” policies have considerable advantages over “stick” policies, which they do not replace, but do complement by drawing on what the behavioral sciences call “libertarian paternalism” and what the book, following Professor Cassese, prefers to refer to as “liberal intervention”. The latter involves the use of more or less subtle nudges, which encourage the taxpayer’s voluntary compliance with his or her tax obligations while at the same reducing any costs to the public treasury – and to the public at large – that result from audit investigations and the enforced collection of taxes and penalties. Developing these fundamental ideas, which are the book´s backbone, Nudging’s Contributions to Good Governance and Good Administration – Legal Nudges in Public and Private Sectors begins with a foreword by Ismael Peña-López, director of the School of Public Administration of Catalonia, accompanied by a chapter of preliminary considerations to the analysis, written by the American Law Professor Cass R. Sunstein. A total of 13 authors deals with the issues explained before and other aspects.

The analysis begins with a brief explanation of the history of the insights generated by the behavioral sciences, an area in which several Nobel prizes have been awarded in recent years. The chapter explains the bounded rationality of human beings highlighted by behavioral sciences, the concept of biases and nudging, and their consequences for law and governance, using the Covid-19 pandemic as a paradigmatic example of an area where nudges can be used. This is followed by an overview of the most common criticisms of nudging. Although behavioral insights and nudging appear promising in order to achieve simpler, more efficient and effective administrative activity in the service of general interests, they have given rise to several criticisms as regards their impact on citizens’ rights. The book considers 16 of those criticisms and includes counter-arguments used by different scholars. From a legal point of view, probably the most relevant criticism could be that nudging might be a way of manipulating citizens. Although there are good arguments to answer that kind of criticism, it is essential to be aware of the risks and to develop an effective legal and judicial control to protect the citizen’s rights. The digital revolution currently underway is revealing how these insights are being used by the private sector on a considerable scale, through the use of artificial intelligence or high-precision nudges known as hypernudges. These private-sector nudges are not always in the best interests of consumers, as what are called dark patterns show, so the actions taken by the public authorities for the greater good to protect the rights of citizens and ensure effective administration must take these insights into account. In that sense, dark patterns have been banned by the California Privacy Rights Act (CPRA) of 2020 in the USA and now in Europe by the EU Digital Services Act (art. 25). After that, Jimenez-Gomez´s chapter discusses the role of game theory, behavioral economics and, in particular, the concept of nudging in law and good governance. Behavioral game theory, which combines game theory and behavioral economics, gives a theoretical framework for understanding nudging, as well as its application to good governance. One of the key aspects in this respect is the role of transparency, both with respect to nudging and good governance. Those concepts are also applied to Blockchain technology.

Beyond economics, linguistics plays an important role in the area of nudging and law and has an important place in the book. Getting citizens to comply voluntarily with regulations and legal mandates has always been a key concern of law scholars and professionals as professors Montolio, García and Polanco underline in their chapters. Any act of legal communication can always have different consequences in terms of the behavior of its recipients and their capacity to comply, based on a very diverse range of factors. For instance, the use of entertaining presentations and images has proven to facilitate voluntary adherence to the law. The book aims to analyze the systematic reconstruction and use of nudges as an effective tool in the hands of public authorities to guide people’s behaviors towards certain desirable objectives, without resorting to coercion or financial incentives. However, a number of obstacles arise when introducing these tools within public law: not only does it require rigor in terms of conceptualization and application, but it also gives rise to technical and ethical issues which are considered in the book. The linguistic form plays a critical role in our reactions to messages received and therefore in our everyday decisions. Its importance in the interpretation of messages (different forms give rise to different interpretations) and, as a consequence, its significance in eliciting a given action from a receiver constitute one of the principles of behavioral sciences. The strategic use of language represents a highly effective tool for the modification of behavior. Phenomena such as the perspectivization of reality entailed in the choice of a given metaphor, the mental frameworks evoked by words, the importance of mechanisms of linguistic (im)politeness to call the receiver to action, the construction of identity through language, and the primacy of narrative as a discursive format are only some of the myriad aspects that are doubtless of enormous interest for the advancement of the behavioral sciences.

The government-citizen relationship is a close one, as professor Moreu´s chapter points out. Citizens turn to government agencies to exercise their rights and fulfill their obligations, and, in so doing, defend their right to understand the information they require to make decisions and to act in accordance therewith. Spain’s public authorities are currently taking steps to improve the quality of government-to-citizen communication. And yet citizens continue to make frequent complaints about the difficulties they face to understand government documents. Many documents are perceived as complex, and this presumption of complexity activates such biases as cognitive overload and the discomfort factor, which interfere with decision-making and undermine the efficiency of government activity. The book describes how linguists, based on the insights we have into communication, rhetoric, and persuasion and, more specifically, our commitment to the international Plain Language movement, are promoting linguistic nudges so as to encourage citizens to approach these texts that have such importance for the individual and common good, to read them, to understand and interpret them, and to make appropriate socially responsible decisions.

The final chapter of the book, written by Martin, considers how governments face the need to carry out new policies, for example, to achieve the Sustainable Development Goals. To a large extent, such policies involve changing people’s behavior. However, the tools being used by governments encounter issues for which they may not be the best solution. It is therefore necessary to evaluate what actions to carry out in order to achieve the proposed targets, using limited public resources effectively to meet the publicly stated goals. By institutionalizing the evaluation of public policies, these assessments must include closing the policy cycle. In this respect, the last chapter proposes that external oversight bodies should be part of the process. The study concludes with an afterword written by Ricardo Rivero, professor of Administrative Law and rector of the University of Salamanca, analyzing the legal state of the art in behavioral insights and nudging and advocating their stronger development, especially in some countries which have not developed all the possibilities of the behavioral toolbox. ULEN considers that “behavioral law is one of the most important developments – and probably the most important – in legal scholarship of the modern era”. This development will only express all its potential within a rich conversation with other sciences which can help jurisprudence, legislators, governments, and judges to extract practical consequences from how people decide and behave.

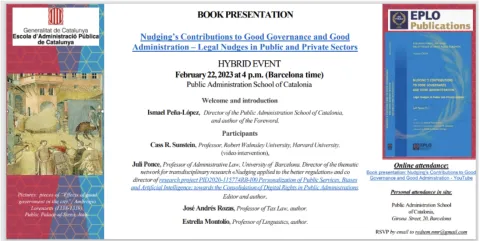

The book Nudging’s Contributions to Good Governance and Good Administration – Legal Nudges in Public and Private Sectors was presented at the School of Public Administration of Catalonia last February 22, 2023. The video of the session is available here.

Juli Ponce Solè

Law Professor at the University of Barcelona, where he has been Assistant Dean and Director of the TransJus, the transdisciplinary research institute at the Law School. He was the Director of the School of Public Administration of Catalonia. He is the editor of the book Nudging’s Contributions to Good Governance and Good Administration – Legal Nudges in Public and Private Sectors, which has appeared in the European Public Law Series / Bibliothèque de Droit Public Européen, vol. CXXVI, published by the European Public Law Organization (EPLO) (2022)

Submitted on Fri, 02/24/2023 - 09:39